Voyager Technologies (VOYG) has moved back into focus after securing a sixth patent tied to its Bishop Airlock, a new NASA Johnson Space Center services contract, and continued progress on the Starlab commercial space station.

See our latest analysis for Voyager Technologies.

All this has come during a choppy period for the shares, with a 30 day share price return of 24.17% decline and a 90 day share price return of 31.05% gain. This suggests momentum has cooled recently after a stronger run.

If this kind of space themed news has your attention, it could be worth seeing what else is out there through our screener of 30 robotics and automation stocks as another way to spot mission critical technology names.

With Voyager shares at US$26.04, a value score of 3, and a reported intrinsic discount of 94%, the key question for investors is simple: is this a genuine discount or is the market already factoring in future growth?

Most Popular Narrative: 34.6% Undervalued

Voyager Technologies’ most followed narrative pegs fair value at $39.83, which sits well above the last close of $26.04, so the story hinges on growth delivering into that gap.

Escalating global focus on missile defense, including Golden Dome and next-generation interceptor architectures, is expanding funded programs where Voyager already holds critical propulsion and guidance roles. This supports sustained revenue growth and rising earnings power as awards convert from development to production.

Curious what kind of revenue ramp, margin lift and future earnings multiple are baked into that fair value line? The narrative leans on aggressive growth, a sharp profit swing and a premium valuation multiple to make the numbers work, but the exact mix of those moving parts might surprise you.

Result: Fair Value of $39.83 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, that upside story runs into real hurdles if Starlab milestones slip or if ongoing EBITDA losses and rising costs persist longer than analysts currently factor in.

Find out about the key risks to this Voyager Technologies narrative.

Another Angle on Value

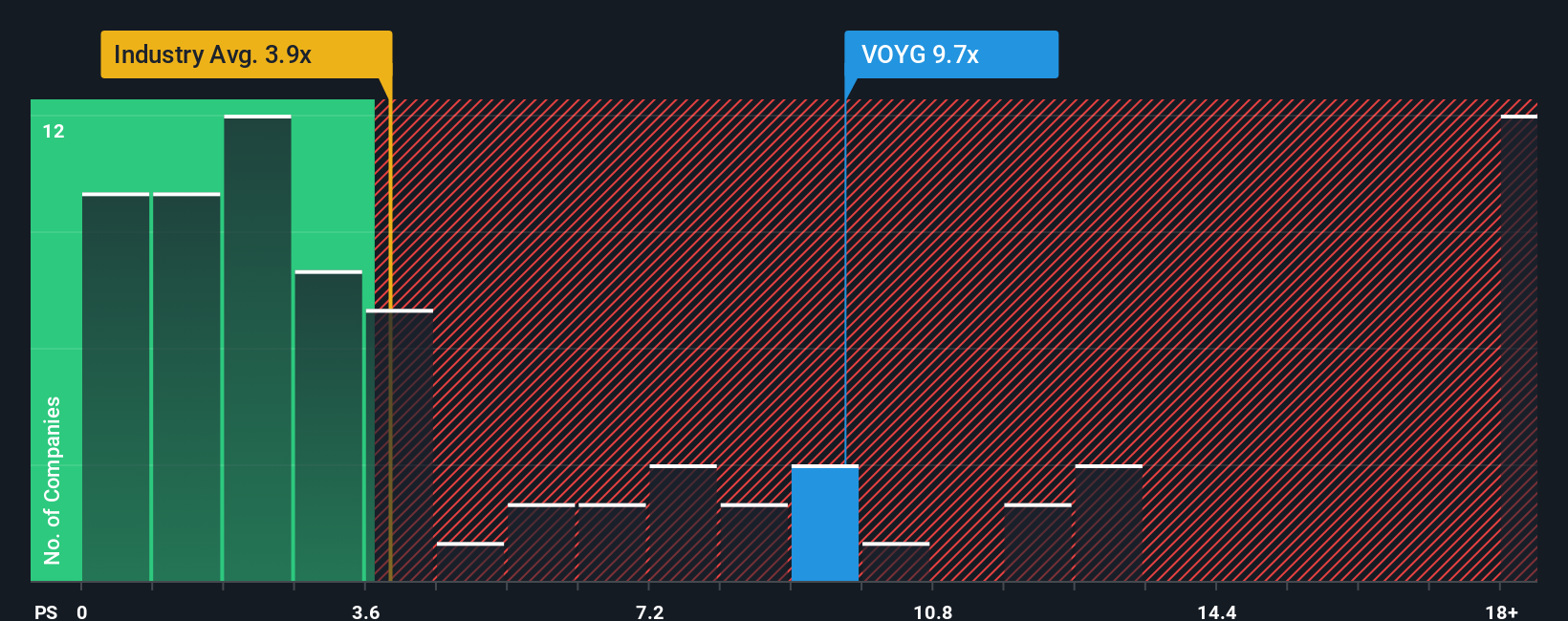

That 34.6% “undervalued” story sits awkwardly next to how the market is pricing Voyager today. On a P/S of 9.8x, the shares trade well above the US Aerospace & Defense average of 4x, the peer average of 2.5x, and even the fair ratio of 5.6x. So is this a mispricing or just a lot of optimism baked into the sales multiple?

See what the numbers say about this price — find out in our valuation breakdown.

NYSE:VOYG P/S Ratio as at Feb 2026 Build Your Own Voyager Technologies Narrative

NYSE:VOYG P/S Ratio as at Feb 2026 Build Your Own Voyager Technologies Narrative

If parts of this story do not quite line up with your own view, you can stress test the numbers yourself and build a custom thesis in a few minutes, then Do it your way.

A great starting point for your Voyager Technologies research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you stop your research here, you might miss companies that fit your style even better, so give yourself a broader field of choices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com