Find your next quality investment with Simply Wall St’s easy and powerful screener, trusted by over 7 million individual investors worldwide.

Voyager Technologies secured its sixth patent tied to the Bishop Airlock, expanding protection of its modular, electrically integrated space infrastructure technology.

The patent covers applications across current and future platforms, including the planned Starlab station and potential deep space missions.

The company also won a new multi year NASA contract to provide end to end mission management services for International Space Station operations.

For investors watching NYSE:VOYG, these moves highlight how Voyager is positioning its hardware and services around key pieces of space infrastructure. The stock last closed at $25.58, with a 5.8% gain over the past week, an 18.1% decline over the past 30 days, and a 7.9% decline year to date. This illustrates how sentiment around near term execution can still be volatile.

Looking ahead, the new Bishop Airlock patent and the NASA mission management contract may influence how Voyager is viewed as NASA increases its use of commercial partners for ISS and future platforms. For investors, the key questions are how effectively Voyager converts these agreements into durable revenue and how its role around Starlab and other missions develops over time.

Stay updated on the most important news stories for Voyager Technologies by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Voyager Technologies.

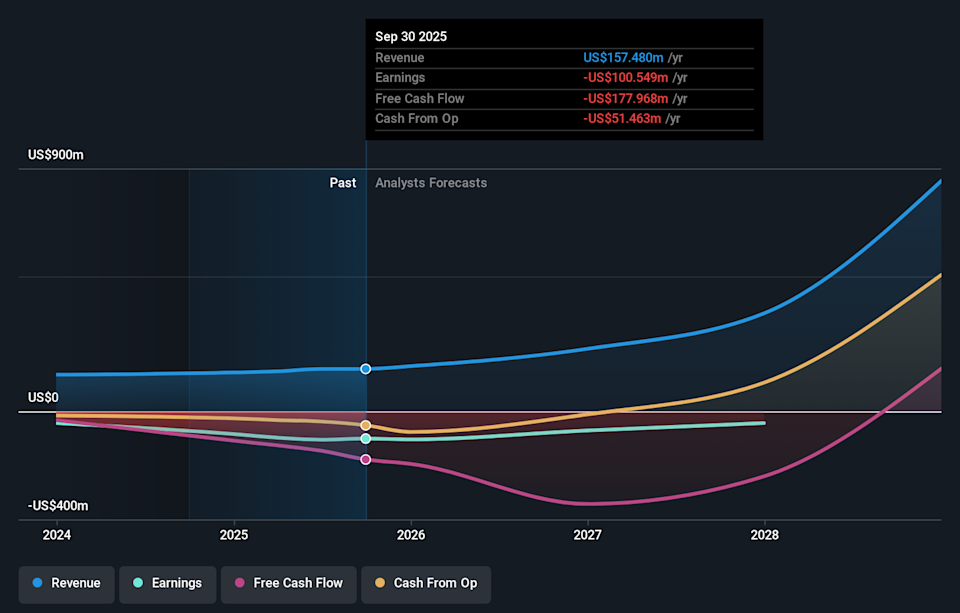

NYSE:VOYG Earnings & Revenue Growth as at Feb 2026

NYSE:VOYG Earnings & Revenue Growth as at Feb 2026

✅ Price vs Analyst Target: At $25.58 versus a consensus target of $43.43, Voyager trades about 41% below analyst expectations.

✅ Simply Wall St Valuation: Simply Wall St estimates the shares are trading 94.2% below their assessed fair value.

❌ Recent Momentum: The 30 day return of about 18.1% decline signals weak short term momentum despite the contract and patent news.

There is only one way to know the right time to buy, sell or hold Voyager Technologies. Head to Simply Wall St’s company report for the latest analysis of Voyager Technologies’s Fair Value.

📊 The new Bishop Airlock patent and NASA ISS mission management contract reinforce Voyager’s role around space infrastructure, which some investors may view as central to its long term story.

📊 Keep an eye on how much revenue and contract backlog ultimately link to the Bishop Airlock, Starlab related work and ISS services, as well as any changes to analyst price targets.

⚠️ The company remains loss making, with a net income margin of about 63.8% loss, so execution risk around turning contract wins into sustainable profitability is significant.

For the full picture including more risks and rewards, check out the complete Voyager Technologies analysis. Alternatively, you can check out the community page for Voyager Technologies to see how other investors believe this latest news will impact the company’s narrative.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include VOYG.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com