Never miss an important update on your stock portfolio and cut through the noise. Over 7 million investors trust Simply Wall St to stay informed where it matters for FREE.

AST SpaceMobile has successfully deployed and unfolded its BlueBird 6 satellite in low Earth orbit.

The satellite carries a record sized communications array designed for direct to smartphone, space based cellular broadband.

This development marks a key step in AST SpaceMobile’s plan to offer large scale, direct to cellular service with telecom partners.

For investors tracking NasdaqGS:ASTS, BlueBird 6 lands at a time when the stock has already delivered a very large 3 year return and a substantial 1 year move of 239%. Shares most recently traded at $96.27, with the stock value score flagged at 1, which reflects how the market is currently treating the name in this space connectivity theme.

The new satellite deployment adds more real world hardware to AST SpaceMobile’s direct to device vision, alongside its existing telecom and technology relationships. As the company works to translate its engineering into reliable service and further deployments, investors may focus increasingly on execution milestones and customer traction rather than only on concept and potential.

Stay updated on the most important news stories for AST SpaceMobile by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on AST SpaceMobile.

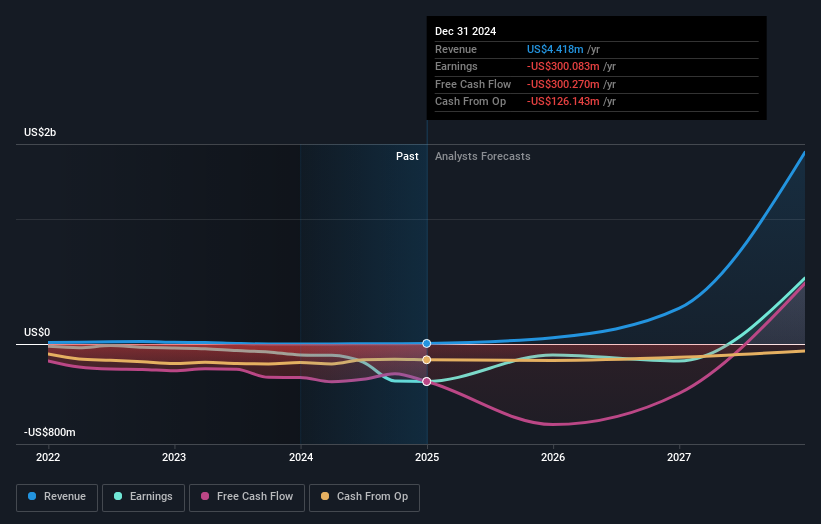

NasdaqGS:ASTS Earnings & Revenue Growth as at Feb 2026

NasdaqGS:ASTS Earnings & Revenue Growth as at Feb 2026

2 things going right for AST SpaceMobile that this headline doesn’t cover.

⚖️ Price vs Analyst Target: At US$96.27, the share price sits roughly 18% above the US$81.64 analyst target, with a wide target range of US$43 to US$137.

⚖️ Simply Wall St Valuation: The shares are described as trading close to estimated fair value, so this move comes with expectations already priced in.

❌ Recent Momentum: The 30 day return of about 1.4% decline suggests the stock has cooled slightly after its strong 1 year move.

There is only one way to know the right time to buy, sell or hold AST SpaceMobile. Head to the Simply Wall St company report for the latest analysis of AST SpaceMobile’s Fair Value.

📊 The successful BlueBird 6 deployment gives the direct to smartphone story more tangible progress, which can help anchor expectations around future service rollout.

📊 Watch how the company converts this milestone into commercial agreements, service reliability metrics and any updates to revenue or cost guidance as the constellation builds out.

⚠️ The stock has been highly volatile recently and shareholders were diluted in the past year, so position sizing and risk tolerance are especially important here.

For the full picture including more risks and rewards, check out the complete AST SpaceMobile analysis. Alternatively, you can check out the community page for AST SpaceMobile to see how other investors believe this latest news will impact the company’s narrative.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ASTS.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com