Quarterly Financial Performance Overview

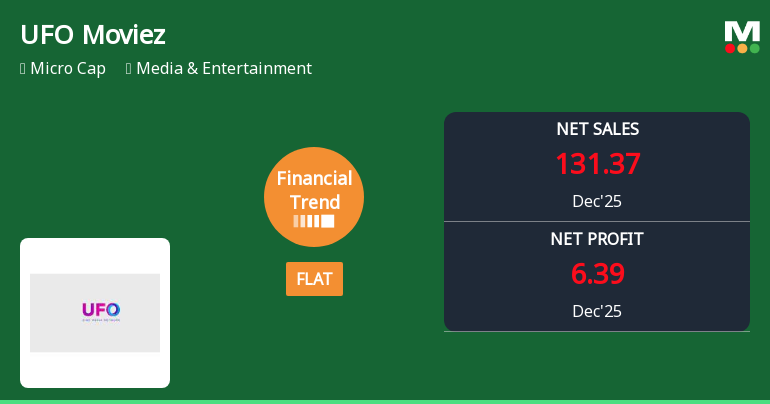

In the December 2025 quarter, UFO Moviez posted net sales of ₹131.37 crores, reflecting a contraction of 5.3% compared to the previous quarter. This decline contrasts sharply with the company’s historical trend of steady revenue growth, signalling challenges in sustaining top-line momentum amid a competitive media landscape. The quarter also saw a steep fall in profitability metrics, with Profit Before Tax (PBT) excluding other income plunging by 60.5% to ₹7.08 crores, and Profit After Tax (PAT) dropping 57.4% to ₹6.39 crores.

The sharp contraction in quarterly profits has been a key factor in the company’s financial trend score tumbling from a robust 16 three months ago to a mere 1, indicating a shift from positive to flat performance. This deterioration has also influenced the MarketsMOJO Mojo Grade, which was downgraded from Buy to Hold on 29 December 2025, reflecting increased caution among analysts and investors.

Operational Strengths Amidst Challenges

Despite the subdued quarterly results, UFO Moviez continues to demonstrate operational efficiencies in certain areas. The company’s Return on Capital Employed (ROCE) for the half-year period remains healthy at 13.16%, the highest in recent times, suggesting effective utilisation of capital resources. Additionally, the Inventory Turnover Ratio stands at an impressive 44.65 times, indicating strong inventory management and quick stock movement.

Moreover, the company’s PAT for the nine-month period ending December 2025 has increased to ₹20.43 crores, signalling that the longer-term profitability picture remains somewhat resilient despite short-term headwinds. However, the Debtors Turnover Ratio has declined to 3.52 times, the lowest in recent history, pointing to slower collections and potential liquidity pressures.

Stock Price and Market Performance

UFO Moviez’s stock price closed at ₹79.23 on 30 January 2026, down 2.19% from the previous close of ₹81.00. The stock traded within a range of ₹78.50 to ₹81.23 during the day, remaining well below its 52-week high of ₹99.55 but comfortably above the 52-week low of ₹59.11. This price movement reflects investor caution amid the company’s recent financial setbacks.

Comparative Returns Versus Sensex

When benchmarked against the broader market, UFO Moviez’s returns have lagged significantly. Over the past week, the stock declined by 0.83%, while the Sensex gained 0.31%. The one-month and year-to-date returns for UFO Moviez were -3.64% and -4.42%, respectively, both underperforming the Sensex’s -2.51% and -3.11% returns over the same periods. Over longer horizons, the disparity widens further: the stock has delivered a negative 2.43% return over one year compared to the Sensex’s 7.88%, and a stark -84.53% over ten years against the Sensex’s robust 231.98% gain.

Sector and Industry Context

Operating within the Media & Entertainment sector, UFO Moviez faces intense competition and evolving consumer preferences, which have impacted its recent financial trajectory. The sector has witnessed rapid digital transformation, with content consumption shifting towards OTT platforms and digital media, challenging traditional players to adapt swiftly. UFO Moviez’s flat financial trend and margin pressures may partly reflect these structural changes, necessitating strategic recalibration to regain growth momentum.

Outlook and Analyst Sentiment

Given the recent financial performance and operational challenges, the company’s Mojo Grade downgrade to Hold signals a more cautious outlook. While operational efficiencies such as high ROCE and inventory turnover provide some comfort, the sharp declines in quarterly profitability and sales growth raise concerns about near-term earnings visibility. Investors should monitor upcoming quarterly results closely for signs of margin recovery and revenue stabilisation.

Investment Considerations

Investors should weigh UFO Moviez’s operational strengths against its recent financial setbacks. The company’s ability to maintain a high ROCE and efficient inventory management is encouraging, but the contraction in sales and profitability cannot be overlooked. The deteriorating Debtors Turnover Ratio suggests potential cash flow challenges, which could constrain growth initiatives.

Furthermore, the stock’s underperformance relative to the Sensex over multiple timeframes highlights the need for cautious portfolio positioning. While the Media & Entertainment sector offers long-term growth opportunities, companies like UFO Moviez must demonstrate adaptability to shifting market dynamics to justify renewed investor confidence.

Conclusion

UFO Moviez India Ltd’s flat quarterly performance and margin contraction mark a departure from its earlier positive financial trend. The downgrade in Mojo Grade to Hold reflects increased uncertainty about the company’s near-term prospects. While operational metrics such as ROCE and inventory turnover remain robust, the sharp declines in quarterly profits and sales growth underscore the challenges ahead. Investors should monitor the company’s strategic responses and upcoming earnings releases to assess whether UFO Moviez can regain its growth trajectory in a rapidly evolving media environment.

Unlock special upgrade rates for a limited period. Start Saving Now →